Nevada Self Directed IRA LLC

includes:

- ESetup the LLC in State of Nevada

- EPrepare and File the Articles of Organization with the State*

- EProvide a Customized Self Directed IRA LLC Operating Agreement That Meets Requirements of the IRS

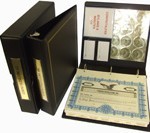

- EProvide the LLC Record Book including Membership Certificates, Minutes, Seals, Transfer Ledger and Binder

- EObtain the EIN from the IRS

- ECo-ordinate setup with an IRS approved Custodian**

- E24/7 Online and Email Customer Support

- EToll Free Customer Support Phone

- E1 Year Access to Private Online Portal

*Plus State Filing Fee **Plus Custodian Fees

Call Now to Get Started!

1-800-936-0872

9am – 5pm PST

Monday – Friday

Better Business Bureau Accredited Business with an A+ Rating since 2008

Tom Walker has character and Integrity you don’t find these days,as I have looked for the last six months where and how to park a large chunk of cash after working twenty years in the county hospital in Miami, Florida.His patience and wisdom in listening to me far out weighed his own goals.Even when I got cold feet, his knowledge and understanding guided me through the intense process of fear of the unknown in securing my future. I would highly recommend Mr.Walker to anyone who needed truth in an unknown arena looking for safety

I highly recommend any person who wants the independence and freedom of controlling their own finances to have Self Directed IRA create a Business Plan for you and break the chains of the ordinary investing vehicles out there. They are always available for questions answering and support, even after the services ended.

Thank you again for your continued trusting relationship.

With Warm Regards,

There is only one word to describe Tom Walker and Self Directed IRA LLC and that is Awesome! Tom made everything go smoothly and was always available to answer all of my questions no matter how many times I called. I would recommend Tom and Self Directed IRA LLC to anyone who wants to take control of their retirement account.

Thanks Tom

Call Now to Get Started!

1-800-936-0872

9am – 5pm PST

Monday – Friday

Better Business Bureau Accredited Business with an A+ Rating since 2008

The information contained on this website has been supplied as general information. We do not provide investment, legal or accounting advice. We recommend that you seek advice from a qualified local investment, accounting or legal counsel.